by John Stossel –

by John Stossel –

Marty the Magician performed magic tricks for kids, including the traditional rabbit-out-of-a-hat. Then one day: “I was signing autographs and taking pictures with children and their parents,” he told me. “Suddenly, a badge was thrown into the mix, and an inspector said, ‘Let me see your license.'”

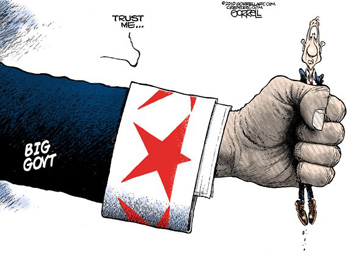

In “Harry Potter” books, a creepy Ministry of Magic controls young wizards. Now in the USA, government regulates stage magicians—one of the countless ways it makes life harder for the little guy.

Marty’s torment didn’t end with a demand for his license. “She said, from now on, you cannot use your rabbit until you fill out paperwork, pay the $40 license fee. We’ll have to inspect your home.”

Ten times since, regulators showed up unannounced at Marty’s house. At one point, an inspector he hadn’t seen before appeared. He hoped things had changed for the better. [Read more…]

by Chris Banescu –

by Chris Banescu – by Chris Banescu –

by Chris Banescu – by Paul Bedard

by Paul Bedard If you knew a dollar invested in something would wind up losing more than a dollar, would you consider that a good investment?

If you knew a dollar invested in something would wind up losing more than a dollar, would you consider that a good investment? by Lachlan Markay –

by Lachlan Markay – With unemployment still above 9 percent, Americans are searching for answers that will lead to quality, lasting jobs. Past failures of jobs programs show that addressing the symptom instead of the disease has yet to lead to real job growth.

With unemployment still above 9 percent, Americans are searching for answers that will lead to quality, lasting jobs. Past failures of jobs programs show that addressing the symptom instead of the disease has yet to lead to real job growth.